As parents, it is just our basic instinct to put our kids first. Whether it be safety, finances, or just happiness in general. We want what is best for them, so we invest countless amounts of energy, time, and money into making sure that the are healthy, happy and hopefully have a nice little nest egg for college when the day comes. But all of that time spent putting them first means that much of the time we are giving up things for ourselves. Anyone who’s scrimped and saved for braces, doctors’ visits, that must-have new video game, holiday shopping or stayed up late wrapping presents or baking cookies knows what I’m talking about.

But in all this focus on ensuring our children’s future we need to make sure that we are planning for our own future as well. After all, I’m grateful my parents not only have a solid plan for their retirement years but invested in our future by teaching us how to plan and save from the time that we were young enough to understand what it meant. Planning for our own retirements can really be a gift we pass on to our children. Even with my children being young, they are old enough to appreciate the value of a dollar. We make them spend their allowance on things that they want, and we also teach them control by making them save, even when they may really want something. They learn that saving now means more money later, which is a lesson that we all could stand to stop and think about from time to time.

This time of year I’m often focusing on what to get for the kids. Winter clothes, Christmas presents, and so on. But this year I’m taking a couple minutes for myself to visit AceYourRetirement.org for personalized, simple tips to make sure I’m on track with my retirement savings. We have always been good with our finances, but regardless of how good you think you are, if you are not a finance expert or a number whiz, it cannot hurt to take a look at where you are and see what can be improved upon. I think that everyone should do this often, even if you have a solid plan in place. Knowledge is power and in this case it is also your future!

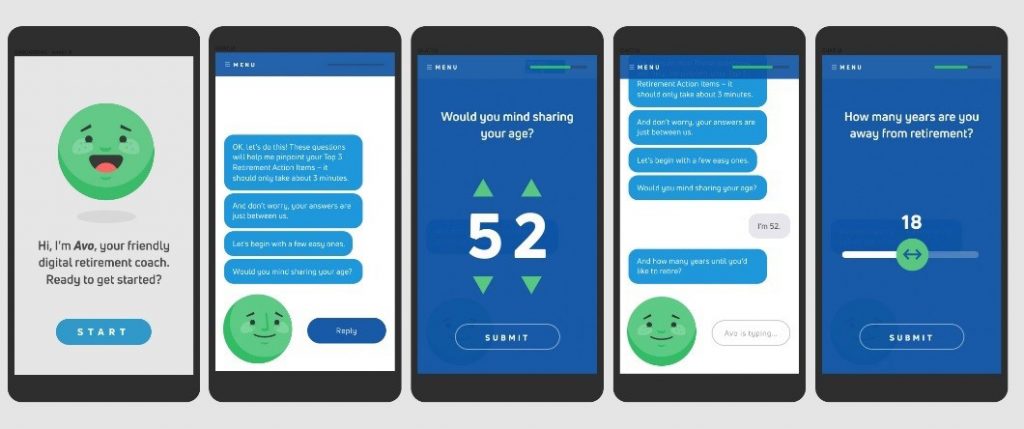

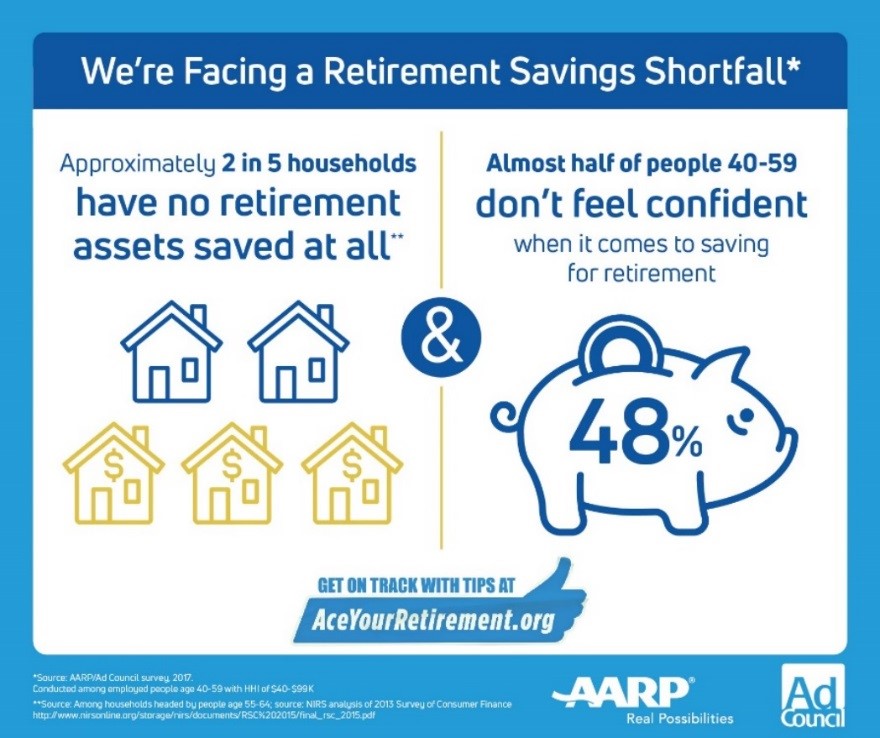

It was so helpful to me to see a couple areas that I could adjust to help improve the financial situation of our family. And, it only took about 3 minutes out of my busy schedule! Even the busiest person has 3 extra minutes in a day that they can take to check up on what their retirement forecast looks like, don’t you think? It’s not surprising that our family is one of many doing this financial juggling act. Many Americans have almost no retirements savings, nearly half in fact! But it’s not too late to get started! I know I feel better after chatting with Avo at AceYourRetirement.org.

We work hard for our kids and our family – and now we are working hard for our own future as well. What will you be doing to help ensure your own future?

Here are a few tips to consider to help you maximize your retirement savings:

- While gathered with your family for the holidays, discuss your savings plans and long-term retirement goals, and what you can do today to achieve them. It’s important for everyone in the family to be on the same page about your financial goals and priorities.

- Start planning now what age you plan to retire and when you plan to start taking your Social Security benefits. Earning a few more years of income could really help you grow your nest egg, and delaying when you start collecting Social Security increases your annual benefit.

- If your employer offers matching funds for your retirement savings plan, make sure you’re contributing at least enough to get the full employer match.

- Brainstorm ideas for earning money in retirement, such as turning a hobby into a source of income, or taking on seasonal part-time work

- Visit AceYourRetirement.org to get your personalized action plan in just three minutes. Your digital retirement coach, Avo℠, will reveal the top three simple, practical things you can do right now to make sure your retirement plan is on track.