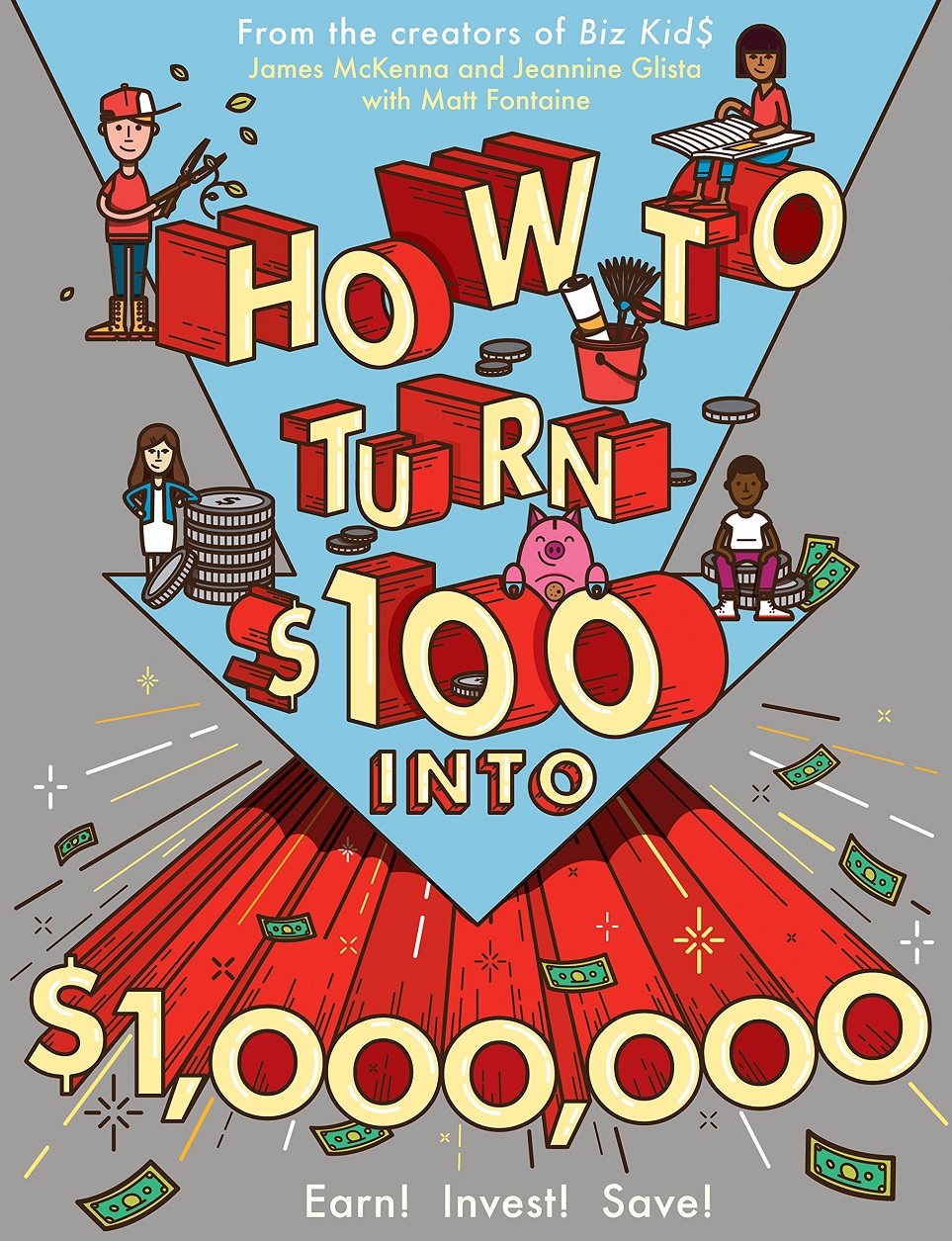

“How to Turn $100 Into $1,000,000: Earn! Invest! Save!”

Nontraditional Roadmap for Financial Success and Responsibility in Teenage Years

New York, N.Y. – While teenagers may think they know everything, most know little about managing money. In fact, 87% of teens don’t know much about earning, spending, or saving money—and only one in 10 knows how to make simple financial decisions. On April 6—Financial Fitness Day—parents, teachers and kids will have access to the new go-to resource, How to Turn $100 into $1,000,000: Earn! Invest! Save!, an illustrated and easy to understand comprehensive first guide to earning, saving, and investing, that will inspire important dialogue about money between parents and their kids.

“Children are our greatest asset, yet the majority live in poverty today,” said James McKenna, one of the book’s co-authors and co-creator of the Emmy Award-winning public television series Biz Kid$, citing a recent report from the Southern Education Foundation that found that for the first time in 50 years, a majority of US public school students come from low-income families. “Teaching them money smart tips at a young age is crucial, and will help provide them with the tools to become financially responsible and more entrepreneurial early in life.”

“The skills of earning, investing, and saving money are more important now than ever before, with 17 states including financial literacy in their curriculum, and 43 incorporating it in their educational standards,” said Jeannine Glista, also one of the book’s co-authors and co-creator of the Emmy Award-winning public television series Biz Kid$. “With a little focus, patience, confidence, and knowledge, any child can develop a million-dollar mindset. And the best part is, it’s easy.”

The co-authors have packed How to Turn $100 into $1,000,000: Earn! Invest! Save! with lively illustrations, engaging infographics that make difficult concepts easy to understand, and interactive worksheets, making this book more of a guide for aspiring young millionaires to start small, but think big. Here are tips that will be revealed in the book, and parents will find useful for raising financially savvy children:

- Tip #1: Open a savings account at a bank or credit union, no matter how little you open it with

- Tip #2: Chart a course to freedom—set short term goals to buy a “Super-Cool Thingy”—write them down and check in every month

- Tip #3: Get creative about making money—one kid made and sold beaded jewelry on the weekends and turned $50 into a dirtbike in a year

- Tip #3: Build a budget and check it weekly—include your allowance, babysitting, and that $5 gift from your Grandma—save up to $100, then make regular saving a habit

- Tip #4: Make a job master plan—fold a piece of paper in half and write your skills on half and your interests on the other, then head out and be the best hamburger flipper, taco stuffer, or cherry picker ever

- Tip #5: Create a financial diary to track your spending

- Tip #6: Don’t forget to move some money into an emergency fund—because you never know when you might need it

- Tip #7: There are four things you can do with money: spend, save, donate and invest. Set some goals for yourself on how you plan to allocate your money

- Tip #8: A business starts with an idea. As a family, brainstorm ideas for a product or service. One good way to get started is to think about a problem that needs to be solved, and then think about what product or service could solve that problem.

Co-authors James McKenna and Jeannine Glista, along with Erren Gottlieb and Jamie Hammond, are also co-creators of Biz Kid$, a national financial educational initiative based on the Emmy Award–winning TV series of the same name. Matt Fontaine is a contributing writer living on Vashon Island, Washington.

Co-created and co-executive-produced by the creators of Bill Nye the Science Guy, the Biz Kid$ series is broadcast worldwide and accessible through numerous outlets. Since its premiere in 2008, the show has been seen by more than 150 million people. Biz Kid$ has been approved as a financial education recommended resource in 16 states.

Workman Publishing Company, founded in 1968, is an independent publisher of adult and juvenile trade books, and is known for its innovations that have stretched the boundaries of traditional books. Its wide range of nonfiction titles includes cookbooks, parenting books, and gardening, humor, and self-help books, all published to inspire, inform, entertain, enrich with passion, authority, and integrity

MBS,

I haven’t been able to read one of your posts since you recommended An Invisible Thread, but I’m sure glad I caught this one! I’ve always found it a shame that our schools don’t teach investing tips, even at the simplest levels, until college. By then most young people have already formed destructive spending habits. Looking forward to reading more insightful posts; keep up the good work.