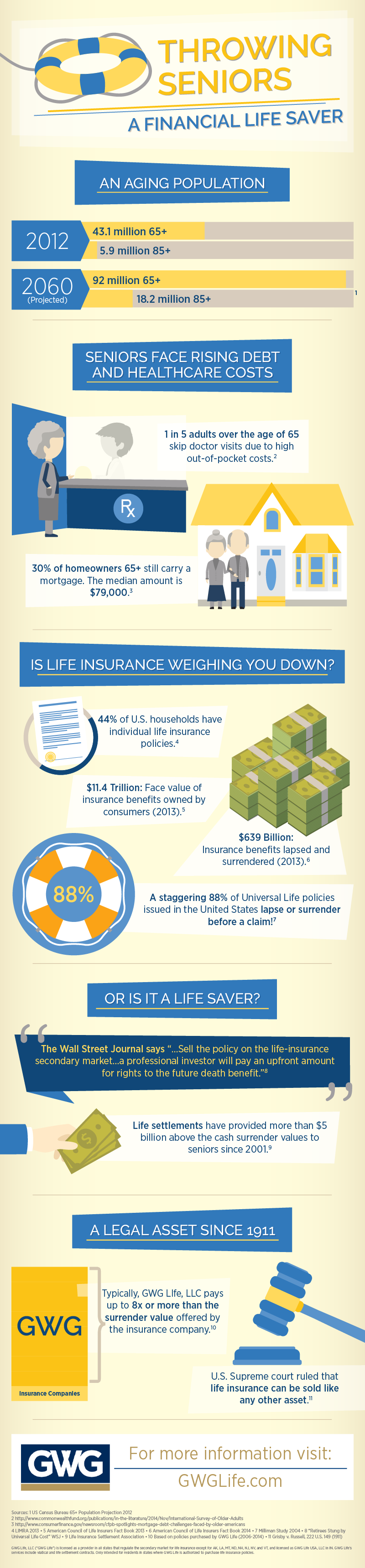

GWG Life understands the retirement crisis and the setbacks associated with an influx of people entering retirement. Many families are faced with parents and grandparents who cannot afford the expenses associated with aging.

GWG Life put together an infographic explaining the benefits of seniors selling their life insurance and how doing so can bring freedom to an entire family.

An estimated one in five adults over the age of 65 skips prescription refills and doctor visits due to high out-of-pockets costs. This raises the risks of decreased health and may result in premature assisted living costs. 30% of homeowners age 65+ owe an average of $79,000 on their mortgage. This is a debt that many seniors can no longer afford once they enter retirement.

$639 billion dollars of life insurance benefits were lapsed and surrendered in 2013 as well as a staggering 88% of Universal Life policies lapsed and surrendered before they were claimed. The Wall Street Journal says, “…Sell the policy on the life-insurance secondary market…a professional investor will pay an upfront amount for rights to the future death benefit.”

By avoiding loss associated with life insurance, seniors have the potential to earn at least 8x more than the surrender value offered by insurance companies. This can bring financial security and added income to sustain a lifestyle, pay for medical care and potential assisted living costs.

The U.S. Supreme Court ruled that life insurance is an asset and can be treated as a commodity to be sold like any other. This new and improved prospect of retiring has brought piece of mind to families with retired parent and grandparent everywhere.